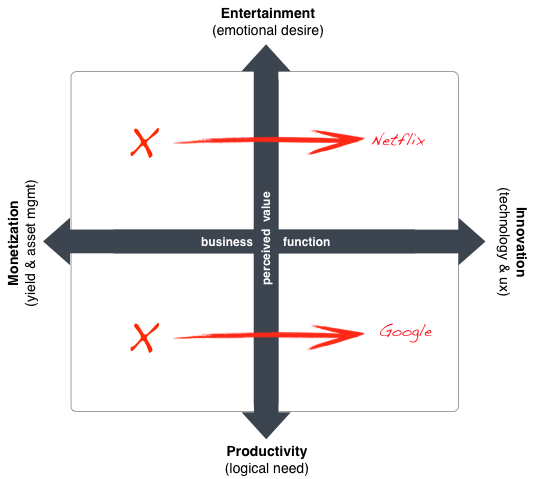

Value Creation Plane

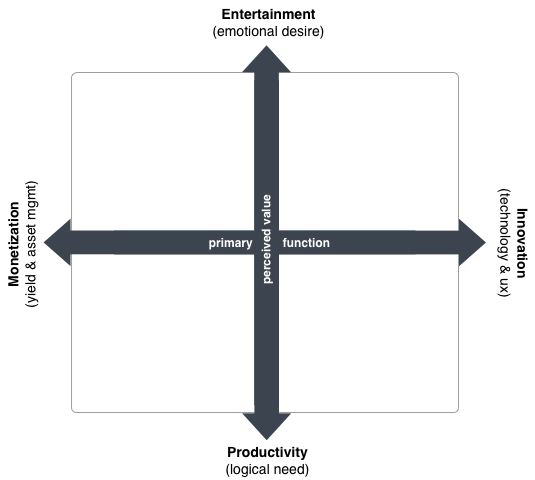

At the heart of any successful business is creating value for others. The Value Creation Plane is a product planning tool that I created, which illustrates the spectrum of value that can be explored when considering how to differentiate your product from others in the market.

Deconstructing Value

Value can be looked at from two different perspectives – what function are you performing to create value, and how is the value perceived by a prospective customer? Function can be described on a spectrum with the monetization of assets at one end and innovation or creation of new assets on the other. Perceived value can be described along a similar spectrum, with productivity at one end and entertainment at the other. This can be mapped to a Cartesian plane as follows:

Business Function

What are you actually doing to create value? Property managers and fund managers help their customers maximize earnings from their assets – an activity we refer to as Monetization. Software and consumer product companies meanwhile seek to create new assets that will bring new or augmented value to their customers. And there are a plethora of business models that fit somewhere in between and share properties of both.

Not all types of value creation make sense at every stage of market maturity. Monetization is a desirable place to be when possible because you can capture maximum profit with minimum risk. To accomplish this, however, you must either be a dominant market leader, or early in a new market lifecycle and able to reach economies of scale quickly, so you can secure preferred sourcing and distribution deals, acquire resources on volume pricing, and thus win any attacks a less powerful competitor may wage.

Innovation meanwhile is a critical mechanism by which you can enter a later stage market or fend off commoditization and margin compression. It is how we push beyond the status quo that might already be saturated, and how we might add additional incremental value to a commodity. Early in a market lifecycle however, these costs would be hard to justify since a more straightforward solution could be developed without the effort or risk. In such a scenario, why focus on incremental value creation when the primary utility is still ripe for exploitation?

Later in the market lifecycle, commoditization occurs when supply exceeds demand, and pricing power is thus transferred to the customer. If two products are sufficiently similar, they are substitutable and subject to price and margin reduction, as one pulls down the price on the other in order to remain competitive. Thus we look to innovation to mitigate this effect and for an opportunity to derive new value in an existing market.

Google was an early entrant to Internet search and innovated through the use of popular citation to yield better results. Internet search is no longer new innovation and that product has moved more toward monetization as they continue to optimize revenue through their Google AdWords products. Meanwhile, they continue to launch new products on the back of the AdWords revenue that ranges from incremental innovation to breakout innovative products such as Google Glass. Netflix meanwhile has begun to innovate beyond their entertainment content distribution business, by creating their own original and high-quality content, thus creating new revenue streams and entrenched customer brand commitment.

Perceived Value

You may have performed some function with the intention of creating value, but how is that value perceived by the customer prospect? Are you solving a problem or delighting them? A logical appeal is one that focuses on productivity and solutions. For example, a software company may provide a solution to someone’s accounting needs or a CRM provider may help to make a sales team more efficient. Equally compelling however is the emotional appeal that focuses on entertainment and inspiration. Connecting with friends, watching an enjoyable movie, or appealing to a person’s need for status are all examples of less logical drivers that create a type of value.

At the end of the day, regardless of how much work you do to generate value, if the customer does not perceive the benefit, then there is no value (Value=benefit-cost). As such, you must connect with the customer either by solving a problem for them or by providing emotional fulfillment. That is a place to begin early in a market lifecycle, and often the most effective position over time, as a market matures, is to transcend to a hybrid of both productive and emotional value, in order to differentiate and to provide augmented value.

Apple classically did this by taking productive tools such as the computer and MP3 player, and adding an exciting entertainment component through design and emphasis on culture (fonts, graphics, etc). By doing this, they transcended comparable competition in the productive tools market, and created the only productive tool that became an extension of culture and personal identity. This provided both entertainment, improved user experience, and an element of status within the more humanities-focused market segment.

LinkedIn took an interesting and inverse approach by building a social network which up to that time was entirely an entertaining consumer product and applied it to professional networking, which is anchored more in productivity than entertainment. By doing so, they’ve successfully imported an innovative toolset to the logic-driven productivity market.

Use this tool to consider where you can most effectively position your offering in your market. Is there already well-formed competition? Are you a market leader or just beginning? This will tell you whether you should focus on innovating or monetizing. And consider whether your offering contributes logical or emotional value primarily. If competition is well-formed along that axis, consider how you can cross over and offer both logical and emotional appeal. These are your tools for tuning to value statement, and identifying the most effective position within your market.